Lesson 1

Lesson 2

Lesson 3

Lesson 4

Lesson 5

Lesson 6

Lesson 7

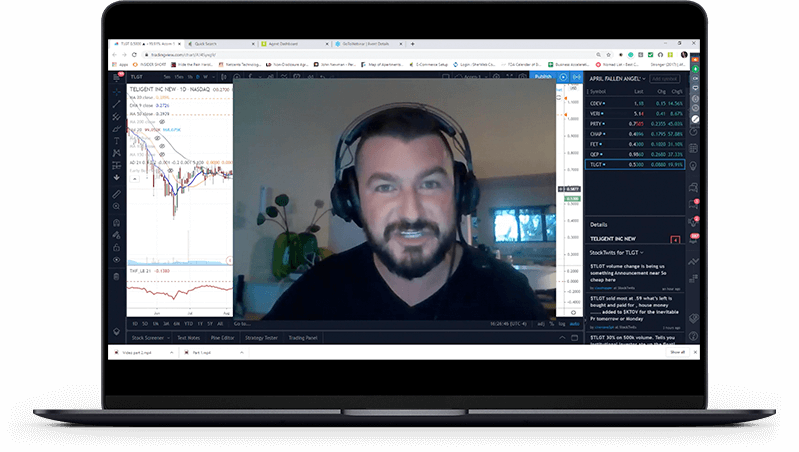

The Fallen Angel Strategy is Acorn’s flagship strategy and pinnacle of the Acorn Wealth strategies and one of the things Acorn was made famous for.

Personally developed by our very own John Seville in 2005; the fallen angel strategy is the culmination of twenty years of strategy building and testing.

Designed for any market condition, this strategy yielded its best results during the 2008 and 2020 market crash declines and after math.

This strategy has been developed to scan for the most powerful bullish and bearish momentum setups on stocks with a incredibly low risk/reward ratio with the highest probability of success.

This course builds on the foundation taught in Patterns & Probabilities by introducing sophisticated indicators and proprietary scans used to find and identify high probability trading setups.

We take an in-depth investigative look into the insider transactions and money flow to gauge market interest in recently oversold equities primed for high probability breakouts. Fallen Angels tend to be Acorn’s most profitable trades. A must for any technical trader’s toolbox.

BONUS:

Included Course Content

Special Ingredients of Technical Trading (Pre-Recorded) In this 90 minute lesson John shows you how you can add further probability to your Trade Selection. This an extremely valuable addition to any strategy and can often be the difference between a win or a loss.

6 Live Webinars John provides more of the practical approach to learning by going out and finding these patterns with you in this interactive live training forum. This is where the real learning comes in as you will be discussing real life situations and potentially real life opportunity. Your homework and questions will be answered in detail during these sessions

Recordings of these sessions will be provide after each ones completion. Recorded sessions from Previous Groups Theses are available for those who can't get enough and want further training examples and practice.

Finding Flags Bootcamp A complete strategy for Trading Bull and Bear Flag Formations. Rated as one of the highest probability patterns there is flag formations will truly be the cherry on top of your Trading Arsenal. We are very pleased with the success many have seen from taking part in this training and can not wait to add more names to the list.

John, I just want to thank you for your most wise teachings. Over the last couple days I was able to enter several of the long stock hedge positions to counterbalance the large number of short options plays I have on. In fact there are only 5 longs right now (CRR, DDD, FELP, OREX, & TPUB).

After the FOMC today the market rallied even further into the close. These 5 hedges + 2 short stock positions (UEPS, ZLTQ) did more than compensate for today’s market rise. They were up a collective $2,125 against a $1,600 drop in my short options positions, for a net $525 gain on the day… amazing, my friend. This is a first for me to have the market go against my general desired direction and I still make money.

If I wasn’t a believer before [I actually was], I am now. Thanks!

I just joined and am enjoying listening to your P&P series. To be honest, I almost blew your free webinar off last week. I work full time and this was what I thought to be "just another sales pitch".

I couldn't have been more wrong! The content of your videos is blowing me away! I've been trading about 3 years seriously and I've seen a bit of what's out there. Your material is so far superior to anything I've seen. I love your transparency and the "simplicity" of your methodology.

Thanks so much for your assistance and your awesome education.